|

| "Wet clean-up on Aisle 74!" |

But even though the IRS is collecting more revenue in fiscal 2016 than in any previous year, free-spending, class-envying Democrats say that it's not enough.

For instance, Bernie Sanders recently bellowed that American corporations aren't paying their "fair share" and cited the flagrant example of tech giant Verizon, claiming "they haven't paid a nickel" in taxes.

And he's right. They haven't paid a nickel. They've paid $35 Billion in taxes in the last two years alone. Which, granted, is simply a rounding error in the Alice-in-Wonderland economic theme park which is currently toot-toot-tootling calliope music between Bernie's hair-sprouting ears.

Are there people and corporations who contort themselves like Russian gymnasts to wriggle out of paying taxes? Of course - but the crazy and largely legal loopholes they're using have been built into the system by both political parties because of their desire to control commerce, as well as the direct influence of lavish campaign donations and other fiscal goodies, both above and below the table.

The IRS is now a nightmarishly complicated, inept, and thoroughly corrupt institution (yes, Lois Lerner, we're talking to you) which needs to be abolished and replaced with a simple and straightforward flat tax which everyone pays into.

Of course, Hope n' Change doesn't seriously expect to ever see that happen. Which is probably good news for our dry cleaner.

BONUS: PAYING FULL FAIR

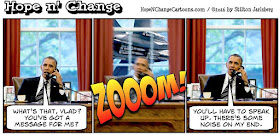

BONUS TWO: CAN YOU HEAR ME NOW?

| |

| A response will soon be coming from Air Force None. |

I think Verizon's customers footed that tax bill. Judge Learned Hand had it right>,

ReplyDelete"Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one's taxes."

Oh yeah. Obama and members of Congress pay HOW much?

ReplyDeleteThe politicians use the tax code to manipulate our social and business behavior. They want us use less alcohol, tobacco and such they tax it. They don’t conceder the unintended consequences of lost jobs. Why do they tax savings? Why do they tax our labor? Why do they tax our investment? What are the unintended consequences of not saving, minimalizing our labor or investments? I used to avoid working overtime because the additional money would push me up to a higher tax bracket.

ReplyDeleteFrance raised it’s taxes “on the rich” to around 75% and the rich started moving else ware. Oops!

American corporations and jobs have been leaving here for decades. Unintended consequences of high taxes, tariffs and labor cost. Of course Obamacare will only add to our labor cost. Are our American corporations paying the cost of the health care for their overseas labor force? I would bet NOT! Are they paying into the Social Security or Medicare funds for those employees? Not likely!

I saw a Bernie Sanders fan on TV today. She thinks the rich should pay 100% Oh, don’t forget the free college. I learned a long time ago that a thing or service has a value of what you paid for it. So, if you get something FREE then it will have little or no value. Plus, everyone will have a degree. Think supply and demand, and you have a worthless piece of paper.

My Doctor once told me that paying his fee was part of the cure. It gives it a value. He was a very wise man indeed.

And to the rev al sharpton april 15 is called Friday, this year.

ReplyDeleteIt's not so much that they pay nothing that bothers me, it's the fact that we pay them for paying nothing that drives me throught the roof.

ReplyDeleteWasn't "Taxation without representation" one of the rallying cries of the American Revolution? And, to repeat for the 8,000,437th time, Margaret Thatcher said "pretty soon you run out of other people's money". And speaking of 'The Iron Lady' and Jolly Old Socialist England, (rhetorical question) what ever happened to the great and wonderful automotive industry that they used to have? Yeah, tax the rich corporation out of existence and give the money to all the people............

ReplyDeleteWhen used by a politician of any stripe, the words "fair share" always mean "more".

ReplyDelete@Joseph ET "My Doctor once told me that paying his fee was part of the cure. It gives it a value. He was a very wise man indeed." Yes, he was wise and I never thought about it that way before. This explains why any health plan in which the patient either doesn't pay, or doesn't think he pays, a mess.

ReplyDeleteMy doctor will not accept new patients because if she did she would have to take Medicaid patients and she doesn't want them. She says they don't keep appointments, they don't follow instructions, they won't take their meds. In short, they waste everyone's time. Why should they? They don't pay for anything, so it has no value to them.

This year I get to make a “individual shared responsibility payment” with my income taxes because I was without health insurance for two months last year. You see, paying outrageous premiums for crap insurance under ObamaCare is our shared responsibility and I failed each and every one of you. Please accept this payment with my taxes as atonement for my shortcomings.

ReplyDelete"The IRS ... needs to be abolished ..."

ReplyDelete*Sighs*

Once again we're presented with the false dichotomy of "abolish the IRS".

"There are a thousand hacking at the branches of evil to one who is striking at the root."

-Henry David Thoreau

Folks...the IRS as an institution isn't the problem. The very concept of an 'Income Tax' is the problem. Eliminate the direct control Fed.Gov has over your life through the fruits of your labor (and all that is attached to and derived from them) and you eliminate the root of the problem.

If the IRS were to be abolished *without* eliminating the 'income tax' (in *any* form), another, possibly more pernicious entity would, by necessity, spring up to take it's place and fill it's roll.

And please don't go bleating on about 'what would we replace it with?' When a house is on fire and you roll up in a firetruck to put it out, you don't first decide which other structure to set on fire to offset the one you are putting out!

Remember...there are other taxes that the IRS as an entity is tasked with collecting...gambling, alcohol, fuel, tobacco, import/export duties, Ect. This whole mindset of 'we NEED the income tax to run the country' is, in my mind, just a bunch of Pavlovian reactionist response as a result of generational Stockholm Syndrome from decades of leftist propaganda. The 'Income Tax' is not used to run the government...it's sole purpose is to be used as a lever for social engineering.

"A fool and his money are soon parted"

ReplyDeleteThe rest of us wait until April 15th.

ReplyDeleteI don't see a simple flat tax as the answer, but definitely something other than what we've got - maybe what we had originally. Taxing a citizen's labor was not in the original plan because it is a form of slavery - a certain amount of your labor time is claimed by the government. At one time, some states used a head tax (a dollar or two a person at the time)to make payment to the federal government. I can't remember what that was for.

Here is a note on flat tax as experienced in a few countries: Estonia implemented the first flat tax in 1994; Lithuania and Latvia followed shortly thereafter. Estonia has taxed citizens from 24 percent (2005) to 21 percent (2009); Latvia and Lithuania have implemented taxes of 25 percent and 21 percent respectively. After finding initial economic success, these countries now experience economic difficulties. Despite high tax rates, according to the countries’ leaders, the tax revenue does not cover state level costs, or the expense of providing welfare to low-income citizens. The impact of the tax flat on Estonia, Latvia and Lithuania leads many to speculate whether the flat tax or the implementation of it is to blame.

speaking of the IRS:

http://www.newsmax.com/Newsfront/irs-koskinen-taxes-not/2016/04/13/id/723822/?ns_mail_uid=9678884&ns_mail_job=1663806_04142016&s=al&dkt_nbr=e7yfdybe

ReplyDeleteTaxation is theft.

What is theft but someone taking something from you without your permission.

And if you gave permission for the government to take your money, you are an idiot.

Is Lefty Lucy married? I'm available, stained sheets and all.

I can do without a Bern during an orgasm

ReplyDeleteAs "progressive" as they claim to be the libs fail to understand there are a million fact-checkers out here, e.g., Dan Rather Bush memo. I want bern to be the donk nominee, as he might put on display for all to see the fallacy of socialism. Ted Cruz would wipe him out.

I can think of few examples of the Progressive "War on the Middle Class" more successful than the "Income Tax". Originally conceived to attack the evil 1%ers, it took less than half-a-century to fully engulf the middle class. For the last half-century, the rent-seeking "rich" have worked it for their benefit, while the "poor" now actually get paid by it. That leaves the middle class, which still makes too

ReplyDeletemoney to be "poor", but lack the resources of "the rich" to avoid it to bear the brunt.

So if you should come across one of those poor and ignorant millennials like Lucy who think Bernie is the bees knees, do remind them that by the time they hit middle-age, Bernie's "screw the rich" programs will be targeting them just as they're arriving at the most affluent years of their lives. (Assuming that they every get to have "affluent years")

Now, to be fair to Bernie, there are a lot of corporations for whom it could be argued are not paying their "fair share". In fact, there are some that actually pay less than zero. But why is that? A cursory look at the list of those paying the lowest rates show companies that have been most friendly to Obama & the Progressives. Is it really a coincidence that big media companies like CBS, Time Warner, and GE (former owner of NBC) should be high on that list? For them, the emperor's clothes are just super.

There's no question about it. There are few investments I know of that pay better returns (10,000% and more) for large corporations in America than "donations" to Washington. So what is the usual Progressive solution to this problem? An even more complex tax code with even more opportunities for exploitation.

Bernie & Verizon: Of course, Bernie & Hillary are trying to make hay over the evil corporation Verizon abusing their striking workers who already average over $130,000-a-year.

I wish my industry was unionized like that!

Speaking of the IRS:

Federal judge calls IRS untrustworthy in tea party case

Well, duh.

And finally, Elizabeth Warren Wants To Take Down TurboTax.

"Under the bill, Americans with simple tax obligations would have the option not to complete a tax return at all, but to instead receive a pre-prepared return from the IRS with their liability or refund already calculated for them."

"Trust us", sez the IRS. Really. But then why shouldn't the IRS think people are that dumb? They voted for Warren, Bernie, & Hillary after all.

@Boligat said "...they don't keep appointments, they don't follow instructions, they won't take their meds. In short, they waste everyone's time. Why should they? They don't pay for anything, so it has no value to them."

ReplyDeleteWhich is a great example of what happens when things become "free". People ultimately develop contempt for things they don't have to pay or otherwise sacrifice for. Just wait until college becomes "free", and our universities become even more like the 5th through 10th years of public high school.

@James Daily- Of course Verizon's customers ended up footing the tax bill; all taxes, in the end, are paid by consumers. I have a good friend who is a Bernie supporter, and she assures others that the "little guys" won't be affected by Bernie's extravagant plans to tax "the rich and corporations." But the raised prices for goods and services to cover those taxes will hit the "little guys" hardest.

ReplyDelete@S.B. Sweeney- Hey, what fun is it being in the ruling class if you can't break the rules?

@Joseph ET- You bring up great points. The entire concept behind "sin taxes" is that the government taxes that which it wants less of. So isn't it interesting when they raise taxes on personal income, investing in companies, manufacturing medical equipment, and so on?

And yes, people who believe that the price of something is "free" won't value it. It becomes a disposable commodity. People need to have skin in the game - no matter what color that skin is.

@REM1875- I still don't understand how a public figure can owe millions to the IRS and not be in jail. I'm pretty sure if MY return shows I've underpaid by $5, I'll end up as a slip-n-slide in a prison shower.

@Fred Ciampi- Actually, "taxation without representation" was originally in my commentary and I'm not sure where it went. But this current election cycle makes it clear that we're experience it right now.

@NemoMeImpuneLacessit- Exactly!

@Boligat- Great real life example. The "academics" create policy oblivious to the inevitable consequences.

@Cat Whisperer- Yesterday I mailed the IRS a check for $39k, on top of the $4k I'd already paid them in quarterly payments. And thanks to their retroactive recalculation of my Obamacare premiums, I paid $1400 a month to insure my wife and myself with a high deductible policy that essentially went unused.

Frankly, I think there should be a national "Thanks For Everything!" holiday in which 50% of the population is encouraged to kiss the asses of those who actually pay taxes.

@Phssthpok- I agree with you in principle, but the reality wouldn't work because our nation has gone too far down the socialist/entitlement path. Voters simply wouldn't support anything which cuts off the goodies. Then again, the IRS could be abolished and not replaced with any income tax if we instituted a VAT (value added tax) at the cash register - but again, as this would be seen as being hardest on the poor, it will never happen (unless we end up with a VAT being added to our current income tax structure).

@Geoff King- I pay quarterly, but can't really disagree with the fool description.

@Linda McWilliams- Good post. And certainly, the primary problem is neither taxes nor their means of collection, but rather the insane level of government overspending and socialistic entitlements. Our country can have freedom or free stuff - not both.

@Bern, The Onan Master- By and large I agree that taxation is theft, but then again I rather like the idea of having things like a military, roads, and a sewer system. But we're being wildly overtaxed in order to enable the underperforming. And I don't mean that in a heartless way; the system is now so skewed that there are very real disincentives to work or be upwardly mobile. As for Lefty Lucy, she's single but lists "stained sheets" among her turn offs.

@Sergio- I think Bernie would be very easy to beat in a general election, but also think there's no chance he'll be the candidate. It will be Hillary or Biden, period.

@John the Econ- A panoply of interesting points. I agree across the board.

ReplyDeleteThere have been many tax ideas floated over the years. A flat tax perhaps being one of the better ones.

ReplyDeleteWhile many would disagree with me, I personally believe the most "fair" tax (if there is such a thing) is a national sales tax with no state sales taxes permitted, and essential food and medical costs exempted.

Everyone would pay, and that should keep the libs climaxing forever.

No tax forms top ever file, no bloated IRS to hound conservative, patriotic, legal American citizens.

The "poor" don't spend millions on lavish homes, showy vehicles, or expensive toys. The so-called rich do, and they would pay more dollars in than those who do not spend lavishly.

And IMO any income tax is regressive as it taxes productivity. You work or save, you pay. You refuse to work or save, you benefit.

A flat national sales tax means your labor and savings are no longer confiscated to pay for the intentionally lazy.

Just my two cents worth.

And finally:

ReplyDeleteI am certain that as you are preparing to file your taxes and perhaps even writing large checks to the government, this will brighten your day. This is where much of your money will be going soon after it clears the bank. It includes some of our favorite topics here at H&C, including:

IRS incompetency

Illegal immigration

The "Earned Income Tax Credit" that has turned our tax system into a vehicle of welfare fraud.

...and the 2-million "undocumented aliens" that are documented enough to cheat the IRS & US Treasury out of over $4-billion dollars a year, almost effortlessly.

And many of them aren't even living here!

https://www.youtube.com/watch?v=0gwWaKkV6RM&feature=plcp

That's right. All you need to do is get an Individual Taxpayer Identification Number (Those are like Social Security Numbers for people who aren't citizens), create a bunch of imaginary children, and file a tax return. The IRS will immediately mail you a 5-figure check, no questions asked. All it takes is a mailing address.

Happy Tax Day!!!

Is that an Iranian F14 buzzing the white house? They are the only ones flying them now.

ReplyDelete@emtgene - the USA did supply Iran a couple of squadrons worth of F-14s prior to the Revolution. They all fell into non-airworthy status due to lack of spares (and anybody left savvy enough to read the manual) post-Revolution.

ReplyDeleteBut get this; The Iranians once hooked up a grounded F-14 behind a 4x4 and towed it to the Gulf coast, attached a whole heap of car batteries to it for juice and attempted to fire one of its AAMs at the patrolling US Navy. True.

Hello,

ReplyDeleteYour Many Happy Returns article led me to comment on your article.

Many years ago, I was making a half million dollars a year. I paid very little in taxes because when my income went up, the IRS started sending a monthly newsletter to me describing how not to pay taxes.

Just one example: I had an S-corporation. The IRS suggested that I buy a piece of land. Then I lease it to the corporation with a 5 year lease. The corporation builds a home or other building on it. The corporation depreciates it over the five year term of the lease. Then the property and the building reverts to me tax-free.

There were dozens of similar suggestions in each monthly newsletter from the IRS.

When my income went down, they stopped sending the newsletters to me.

Bill Moore

I sure wish WE still had F-14's.That and no Obamas,of course.

ReplyDeleteWhy is it any government's responsibility to provide welfare for low income citizens? Just another grab from Social Security which is paid for by people who actually work AND their employers and has been implemented and increased gradually by what we now call progressives. Way out of control. A flat tax on earned income where everyone pays the same percentage and a fair evaluation and control on deserved welfare makes more sense than anything. And....leave Social Security for the people who have paid for it. Welfare needs another source, like out of the income taxes that have been collected. Of course, that might mean some government cutbacks on superfluous spending.

ReplyDeleteHave any of these loose, jawed big-talking wannabe leaders ever said "Flat tax" on what amount? There are three significant numbers on most tax returns but one sometimes has to do their own math to get the first one: Total Gross Income, Adjusted Gross Income, Taxable Income. That's without getting into the details 15% is often mentioned as the flat tax rate. IMO 15% of Total Income is still a hell of a lot of revenue. They could probably give more stuff away for votes.

ReplyDeleteYes, Ted Cruz.

ReplyDeleteI recall hearing that England was suppose to eliminate the income tax and replace it with the VAT tax But just like our politicians, they lied because more money is liked more that less money.

ReplyDeleteThe VAT tax is mostly a hidden tax and its raised at the whims of the politicians.

Information about the “VAT” Tax

Value-added tax (United Kingdom)

VAT: a brief history of tax

Information about the “FLAT” Tax

Flat tax

VAT = Value Added Tax. Like a sales tax on goods and services. Not an income tax. Non residents can get at refund at customs.

ReplyDeleteAs for the Russians buzzing US warships in the Baltic and Black seas, I wonder what the US reaction would be if the Russians were doing teir exercises in the Gulf of St Lawrence or between Florida ans Cuba.

ReplyDeleteIt's just the way they are. Russian leaders are always probing see what you'll tolerate and there seem to be few limits with Obama. Remember: he's a slow-to-non learner. A competent POTUS would have stopped this BS long ago with one private phone call and shrewd humor. Many if not most Russian pilots (military & civilian) have a cocky & smart-ass way about them; whether this is the another case of that or not is not important. Jokingly blame it on that and their superiors, suggesting that Vladimir doesn't have his forces under control. Clearly, we all want it stopped; it's unbecoming and dangerous. And they're probably OK with us firing at the close passes. We might miss and that would be a lot of fun; or hit and we started it. So Vlad: Be warned... OUR forces are in position to retaliate SOMEWHERE ELSE, which will not only embarrass Russia but COST THEM VERY DEARLY. And it will be an accident. Already, we are so sorry, may we offer some help?, because Russia is going to need it. Keep the conversation confidential: one should not go on TV bragging about it. I doubt we have any such plans and I'm sure he hasn't the resolve to back it up. It's not his ass on the line out there, and tolerating further embarrassment of the USA fits his agenda just fine.

ReplyDeleteIrrespective of one's left-center-right politics and approaching this election, the fact that Democrats have not turned on Obama and rejected Clinton is alone, reason enough to not for another at national level for a very long time

@American Cowboy- Good points all. Additionally, the plan you describe could pretty much end the confusion and complication surrounding things like HSA accounts, retirement accounts, and so on. Grow your money (or simply save it) and it won't be taxed if used for approved purchases.

ReplyDelete@John the Econ- Believe me, I was thinking of these very scenarios while stuffing my whopping, tear-stained check into the envelope. It's not just the money being taken away from me that hurts, but the veritable certainty that the money will either be wasted or spent on something I'm morally opposed to.

@emtgene- My bad. I grabbed a picture of an impressive military jet but didn't check to see whose team it belonged to!

@Popular Front- When you say "attempted," I'm assuming the effort failed. Great story!

@Bill- First off, you formerly made a half million dollars a year? Would you like to adopt a very old son? Mostly housebroken?

It's hard to imagine the IRS giving any helpful loophole tips to taxpayers these days. Heck, the odds are against you even getting an accurate answer to a simple question - assuming you can even get the IRS on the phone: most calls go unanswered now because the IRS is so busy enforcing Obamacare.

@millard fillmore- As Sam Cooke once sang, "What a wonderful world this would be."

@Judi King- We need very significant spending cuts, and some Big Ideas on changing the entitlement systems in this country.

@Rod- Ideally a flat tax system would reduce the key figure to just one number with no exemptions. That may sound harsh initially, but without exemptions (and metastasizing variants) I'd guess the actual tax rate could be significantly lower than 15%.

@Judi King- I like Cruz's specifity.

@Joseph ET & Judi King- It's that "whim of the politicians" which pretty much screw up a VAT Tax, Flat Tax, or Income Tax. And, oh yeah, pretty much everything else in life.

@Ciccio- When I posted the cartoon of Obama ignoring a White House fly by, I didn't know Putin's pilots would do ANOTHER such stunt immediately. And I think the Russians can pretty much get away with anything they want right now. Barry doesn't want to do anything which might affect his imagined "legacy."

@Rod- I wish you were advising Obama on how to handle this (alternatively, I hope the NSA agent tasked with reading Hope n' Change passes your suggestions up the line).

And yes, the jaw-dropping love fest the Dems still have for Obama and Clinton (let alone Bernie) show that they're just flat out nuts. Four or eight more years of this nonsense and we're done as a meaningful nation.

Not to be late to the party, but that's an F-14 flying past the window.

ReplyDeleteNot that I don't think the US Navy could want to send a message, too.